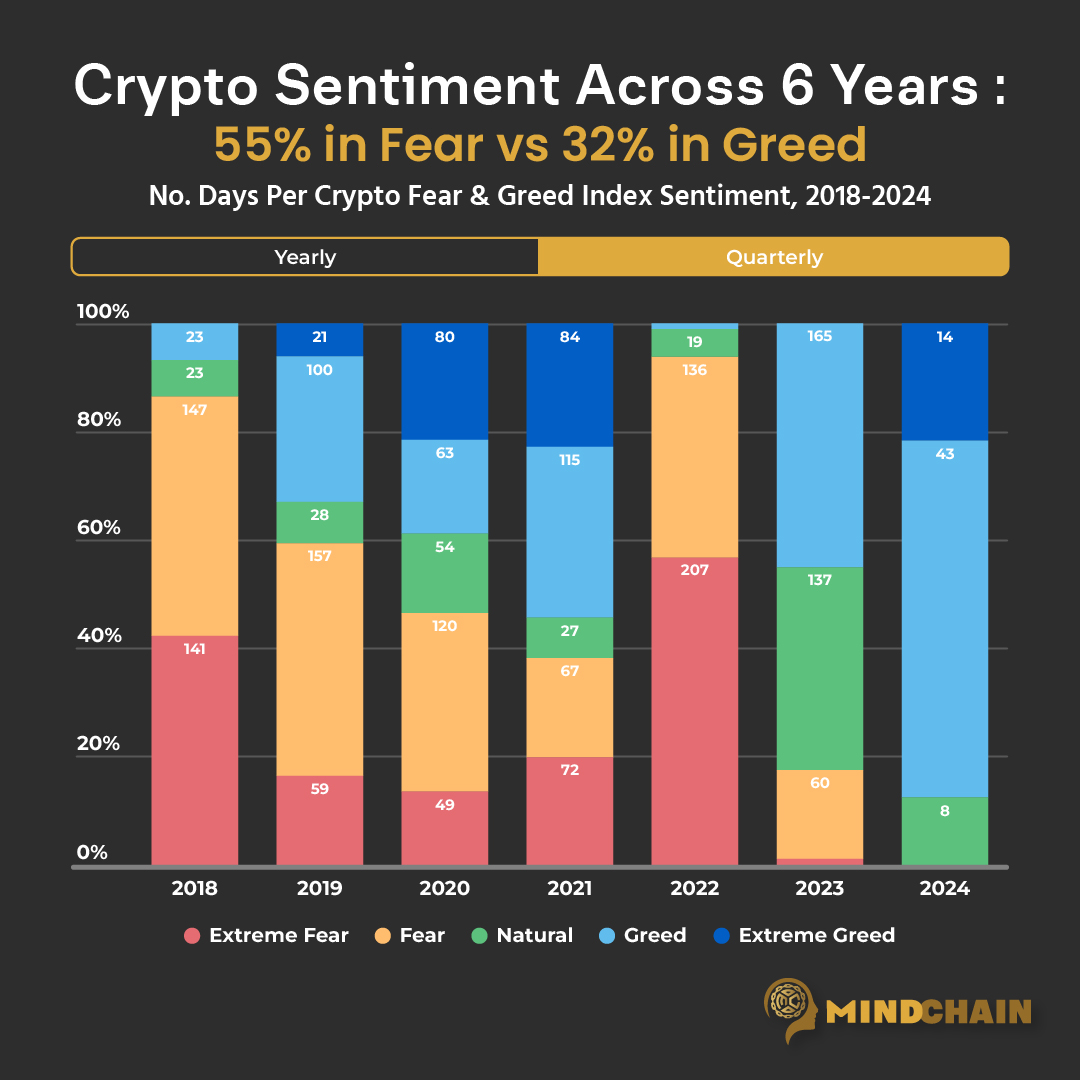

What Has Been the Crypto Market Sentiment Over Time? Over the past six years from 2018 to 2024, crypto market sentiment has been fearful for 54.7% of the time, bullish for 32%, and neutral for the remaining 13.3%. During this period, the average score on the Fear and Lure Index was 45, representing feelings of fear bordering on neutral. This suggests that the duration of cryptos bullish sentiment is shorter than panic and negativity, or that expectations of an up-only market are more short-lived than bearish expectations. It is also worth noting that the fear and greed index has tracked sentiment for more bearish years than bullish. Most recently, the Crypto Fear & Grade Index from November 2023 to February 2024 recorded four consecutive months without a single day in fear sentiment for the first time. It remains to be seen whether the crypto market will continue to experience the dominant bullish sentiment. Until the Bitcoin halving in April. The fear and greed index previously came close to this record just three years ago from November 2020 to February 2021, when Bitcoin rose above $40,000 for the first time. At the time, a consecutive day of bullishness was broken on fear by Bitcoins slight pullback before new highs. Crypto Winter of 2018 to 2019 During the 2018 to 2019 crypto bear market, the fear and greed indices recorded the second and third-highest number of days spent in the fear sentiment range, respectively. In 2018, the crypto market experienced extreme fear for 288 days out of 334 tracked (86.2%), with almost equal numbers of extreme fear (42.2%) and fear only (44%). This happened after the total crypto market capitalization reached a new peak of $0.85 trillion on January 7, then crashed due to the popping of the ICO bubble and returned to $0.13 trillion by the end of the year. The crypto bear market continued well into 2019, with 216 indices registering fear over 365 days (59.2%). This was the year that the Fear and Greed index recorded its biggest overnight drop of 45 points, when the index dropped from a score of 61 (greed) on July 14 to 16 (extreme fear) the next day. Nevertheless, crypto market sentiment was buoyed by a slight mid-term recovery and recorded 121 days of bullishness (33.2%) in 2019, marking an improvement from the previous year. Fear vs Greed in a Full Crypto Market Cycle 2020 had a more balanced mix of sentiments of 46.2% fear and 39.1% greed, reflecting a consolidated and steadily recovering market. In particular, in the second half of the year, the crypto market experienced extreme greed for 80 days (21.9% of the year) and 0 days during the DeFi summer. In the 2021 bull run, the crypto market experienced the most bullishness of all years tracked so far, on 199 days out of 365 days (54.5%). The fear and greed index also recorded the highest overnight spike of 40 points, from a score of 38 (fear) on March 1 to 78 the next day. This year, the total crypto market capitalization increased from $0.78 trillion to $2.31 trillion, while Bitcoin reached new highs and rose above $69,000. The crypto market was particularly buoyant in the first quarter of 2021 and experienced 96.7% leverage most of the time. Sentiments become more mixed in subsequent quarters, however, likely driven by a pullback amid volatile market conditions. Crypto sentiments have marked a complete reversal in 2022 as the market has been in fear for almost the entire year or 343 days out of 365 days (94%). Extreme fear accounted for 207 days, more than fear alone recorded at 136 days. Despite NFTs climbing to new highs in native crypto terms the crypto market has experienced only 3 days of bearishness and nothing for extreme bearishness. Even in the first quarter when crypto ads were featured in the US Super Bowl, the crypto market was already experiencing fear 83.3% of the time. It increased every quarter: 93.4% feared in Q2 as Terra Luna crashed, then climbed to 98.9% in Q3 amid further contagion and deteriorating overall market conditions, and finally reached 100% in Q4 as FTX collapsed. Despite the continued crypto bear market in 2023, sentiment appears stable with neutral accounting at 137 days (37.5%), greed registering at 165 days (45.2%), and fear significantly lower at 63 days (17.3%). Notably, the first quarter of 2023 saw only 3 days of extreme fear and no days of extreme greed. This suggests that the crypto market consolidation has led to the softer sentiment recorded in fear and greed indices. Note that 2018 data was only available as of February 1. This study is for illustrative and informational purposes only and is not financial advice. Always do your own research and be careful when putting your money into any crypto or financial asset.

blog

Crypto Market Sentiment Across 6 Years

Date:2024-03-11 04:45:37

Search

Categories

- Copyright 2024 Mindchain Ecosystem All rights reserved.